Logging for SOX

The Sarbanes-Oxley Act helps to ensure that public companies in the United States of America operate with transparency and are regularly audited independently to ensure accountability is maintained.

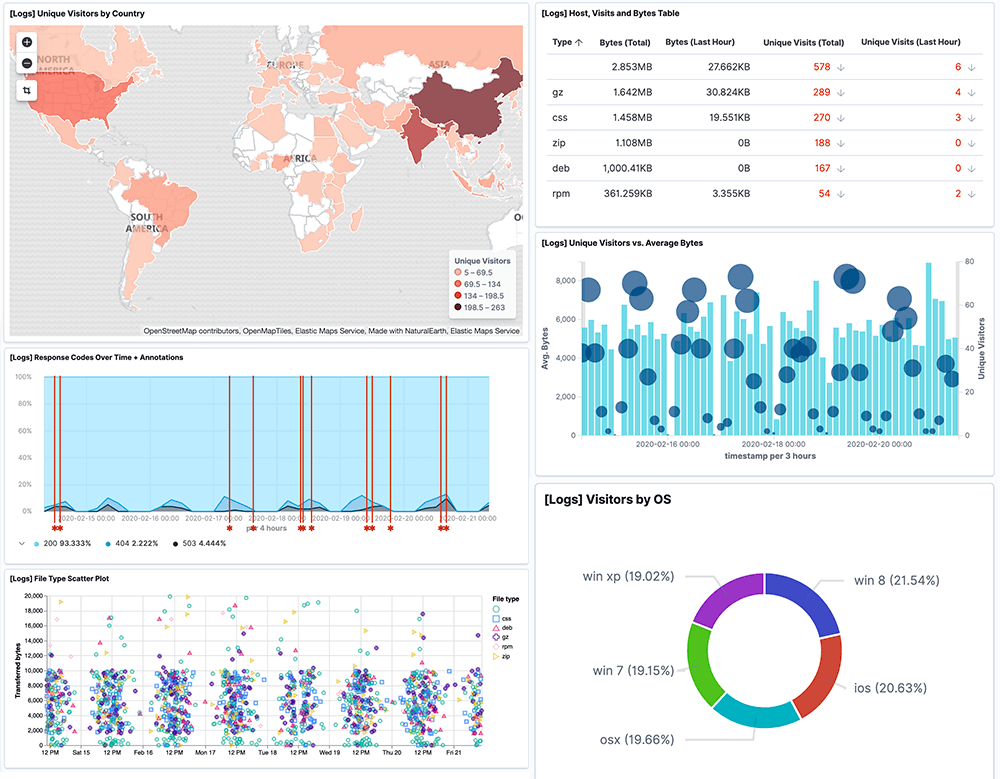

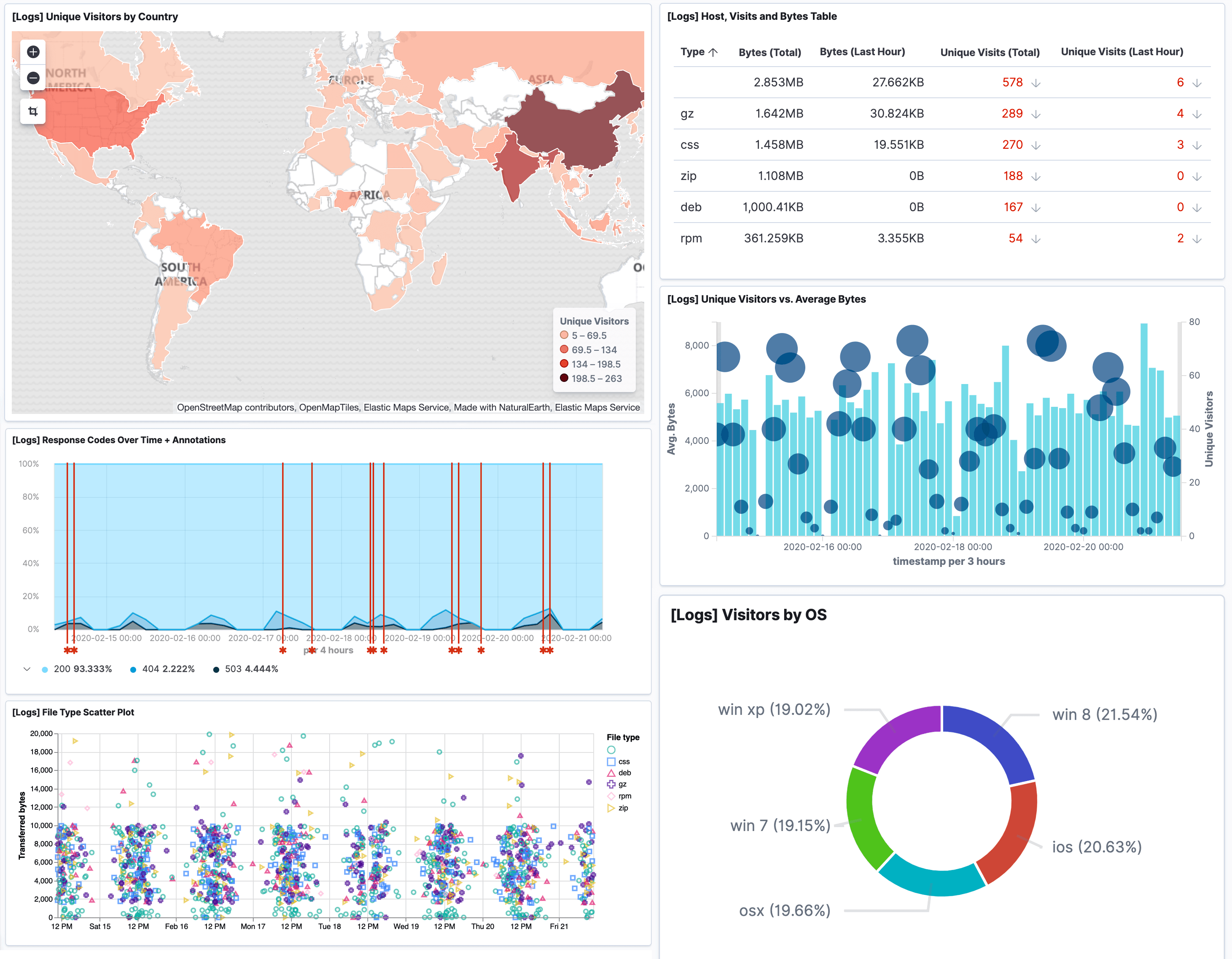

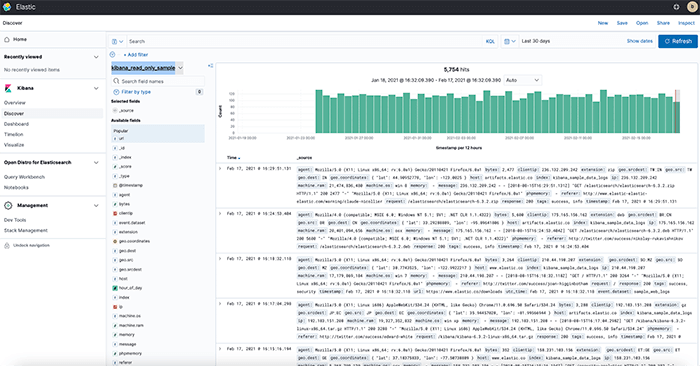

To operate in compliance with the SOX it is worthwhile to consider the importance of observabilty through the use of centralized logging by using a tool such as the one provided by Logit.io.

Logit.io can be used to collect and store logs from many sources, including servers, databases, and applications. Logit.io‘s log data centralization makes it easier for companies to manage and analyze their log data, and to meet SOX record retention requirements.